J.P. Morgan: Global EV, PHEV and Hybrid Sales Will Rise to 60% by 2030

The car industry is undergoing a radical transformation, with most carmakers agreeing the next 10 years will bring more change than the two previous decades. The next target date cited by automakers as a tipping point is 2025, when everything from materials and fuel to cost and the companies that build cars are set to look dramatically different. In this report, the J.P. Morgan Research team explores the rise of the electric vehicle and what the industry will look like by 2025.

By Natasha Kaneva and Ryan Brinkman, J.P. Morgan

jpmorgan.com/global/research/electric-vehicles October 10/2018

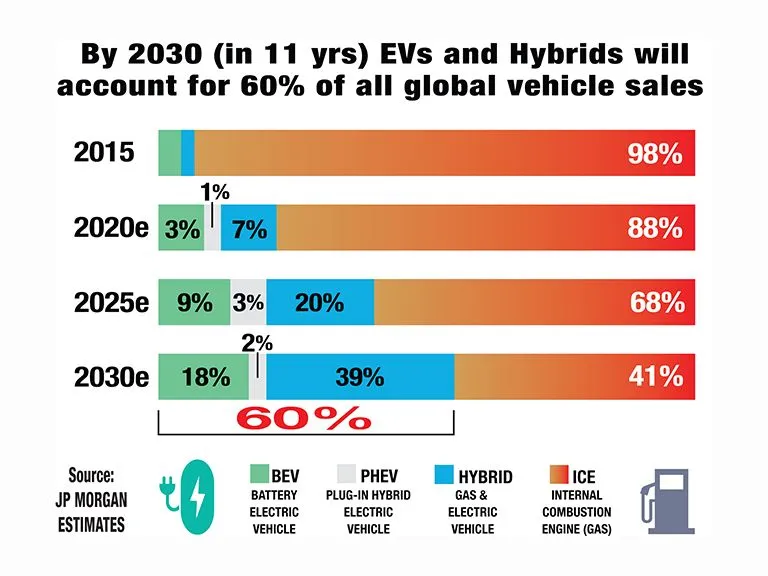

Automakers are preparing to phase out cars powered solely by internal combustion engines (ICEs) as governments look to tackle fuel emissions. The growth in electric vehicles (EVs) and hybrid electric vehicles (HEVs) is climbing and by 2025, EVs and HEVs will account for an estimated 30% of all vehicle sales. Comparatively, in 2016 just under 1 million vehicles or 1% of global auto sales came from plug-in electric vehicles (PEVs).1

By 2025, J.P. Morgan estimates this will rise close to 8.4 million vehicles or a 7.7% market share. While this jump is significant, it doesn’t compare to the kind of growth expected in HEVs - cars that combine a fuel engine with electric elements. This sector is forecast to swell from just 3% of global market share to more than 25 million vehicles or 23% of global sales over the same period.1 This leaves pure-ICE vehicles with around 70% of the market share in 2025, with this falling to around 40% by 2030, predominantly in emerging markets.

For both North America and Europe, hybrids and BEVs are set to lead over the next decade as plug-in hybrids are not proving too popular in either region. In Europe, plug-in electric vehicles (BEVs and PHEVs) will rise from roughly a 2% share of total new sales in 2017 to around 9% by 2025, nearly eclipsing 1.5 million vehicles by the middle of the next decade. A dramatic move away from ICE-only vehicles is expected and by 2025 only plug-in electric vehicles and HEVs will likely be sold. Over that time period, J.P. Morgan forecasts sales of plug-in electric vehicles in Japan and Korea will reach 384,000 vehicles, representing a market share of 6%, while HEVs will approach 1.8 million vehicles or 27% of total sales. Meanwhile in the U.S., tougher fuel economy regulation will likely push automakers to expand their EV offerings, but not with the same degree of urgency as in Europe, where there are looming carbon dioxide emissions targets and fines. Nevertheless, overall EV sales – including BEV, PHEV and hybrids – are estimated to account for over 38% of total sales in 2025.

In terms of production and sales of electric cars, no other nation comes close to China. By 2020, the country is expected to account for a staggering 59% of global sales before easing slightly to 55% by 2025 according to J.P. Morgan data. The rise of mini-EVs with smaller battery packs designed for short-range driving (around 100-150 km) has helped boost the popularity of EVs in China. Prices for mini-EVs start at around RMB 40,000 or $6,250 USD making them affordable. J.P. Morgan’s Research team forecasts the compound annual growth rate (CAGR) of China’s new electric vehicle (NEV) market (EVs and PHEVs) is set to hit 46% by 2020, with 2.5 million units produced that year — 25% above the government's target of 2 million units. This forecast is based on a few key drivers:

Rapid battery cost reductions

Prices are falling by 15-20% per annum as the scale of production ramps up and battery suppliers increasingly give away their margins. This puts China on track to produce EV and internal combustion engine technology at cost parity (for compact vehicles) by 2020. Revised subsidy schemes for 2018 also mean certain models will reach price parity after discounts this year.

ELECTRIC VEHICLE BATTERIES

EV battery manufacturing is dominated by a relatively small number of players. Asian manufacturers hold the lion's share of global production, with Panasonic commanding a 40% stake, followed by LG Chem with an 18% market share. CATL is leading the investment in China and currently accounts for 23% of the global market share. Battery prices have fallen dramatically this decade from around $1,000/kilowatt hour (kWh) in 2010 to about $210-230/kWh last year. For EVs to be cost competitive with ICE vehicles, battery costs must fall to around $100/kWh, something that could be achieved by the middle of next decade or earlier according to J.P. Morgan Research estimates.

“Auto producers and battery makers are very sensitive to raw material costs. Proportionally, the cost of raw materials will increase over time relative to the total cost of the battery pack. In fact, if total battery pack prices drop from $209/kWh to $100/kWh, but raw material costs stay the same, the raw materials cost would account for 56% of the price, substantially higher than today’s 27%.” – Natasha Kaneva, Head of Metals Research and Strategy, J.P. Morgan

As the composition of EV batteries change and the industry expands, the demand and price of certain commodities will be impacted. Mainly driven by China EV sales, global demand for lithium is expected to climb 20% by 2025, according to J.P. Morgan Research forecasts. Increased demand for nickel in EV batteries is also expected to push prices higher, with the battery sector on track to become the second-largest consumer of nickel after the stainless steel market by the middle of the next decade. Of the base metals, after nickel, copper follows as a close second in terms of demand growth potential. As well as being used throughout an entire electric vehicle, the metal is also used in charging ports or stations and cables. Aluminum demand will also get a substantial boost as EVs grow in popularity and vehicles get lighter.

CHARGING UP

As the adoption and use of electric vehicles grows, charging infrastructure needs to catch up and China is winning on that front too. By 2020, the State Council has a target of 4 million new charging posts and 12,000 charging stations, in which state-owned companies such as China State Grid are investing heavily to support. In Europe, utilities and oil majors will be the main drivers, after Shell and Engie entered the market in 2017 with the acquisitions of NewMotion and EVBox, respectively. In the U.S., California is taking the lead with plans to invest $1 billion in the charging network.

WHICH MANUFACTURERS ARE TAKING THE LEAD?

In China, Beijing Auto Industry Corporation (BAIC), BYD and ZhiDou are among the major producers. BAIC's EC180 was China's best-selling electric car last year, which after subsidies starts at around $7,750, with a range of around 110 miles and a top speed of 62 miles per hour. General Motors recently announced plans to launch 10 heavily electrified vehicle models in China from 2021 through 2023, adding to the 10 it already had planned for 2016 through 2020.

Headquartered in California, Tesla specializes in premium BEVs, with prices for its Model S sedan and Model X SUV closer to $100,000. The automaker launched the “mass market” Model 3 last summer for around $35,000, but production delays have hampered its roll out. In Europe, the sporty BMW i8 is one of the priciest EVs on the market, starting from over $140,000. But the Nissan Leaf and Renault Zoe are proving the most popular, with 20.6% and 19.3% of the BEV market respectively, thanks to their high range (250km-300km) and low cost.

"The market is going to be flooded with multiple ways to own electric powered vehicles. Interestingly, among the premium makers, BMW is first selling smaller EVs before venturing to sell a large SUV electric range. This is in clear contrast to Audi and Mercedes.” – Jose Asumendi, Head of European Automotives, J.P. Morgan

Driving into 2025: The Future of Electric Vehicles

Head of Metals Research & Strategy, Natasha Kaneva, and U.S. Auto analyst, Ryan Brinkman, discuss how the rise of electric vehicles will affect the car industry.

jpmorgan.com/global/research/electric-vehicles October 10/2018

Recent Posts

- The 2022 Audi Q4 e-Tron SUV combines performance, practicality and luxury

- Ford's 2022 F150 Lightning All-Electric Truck is in high demand

- Legendary Audi performance is at the heart of the 2022 Audi e-tron GT and its RS sibling.

- Meet the Lexus RZ 450e – the luxury brand’s 1st EV

- The 2022 GV60 is Genesis’ first all-electric vehicle