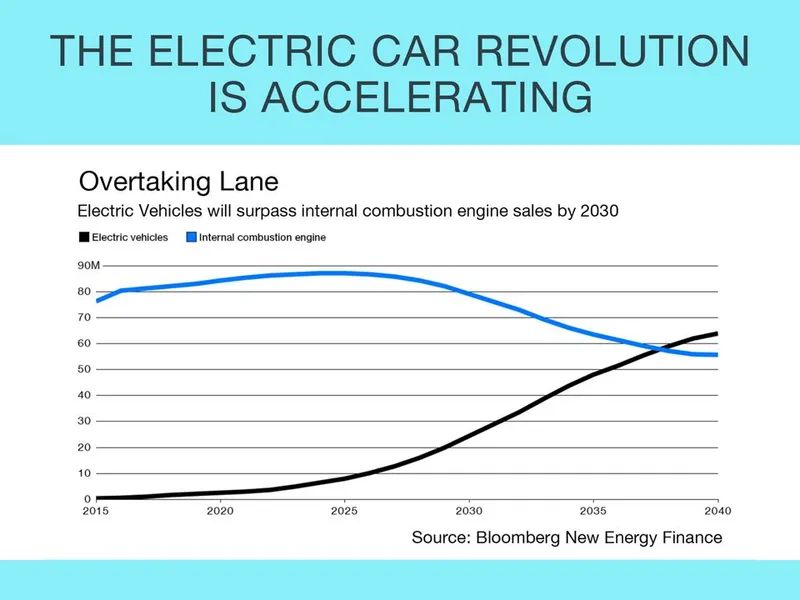

The Electric Car Revolution Is Accelerating

• Electric cars will be as cheap as gasoline models by 2025

• Battery manufacturing capacity will triple in the next four years

Jess Shankleman / Bloomberg / July 7, 2017

Electric cars will outsell fossil-fuel powered vehicles within two decades as battery prices plunge, turning the global auto industry upside down and signaling economic turmoil for oil-exporting countries.

The Bloomberg New Energy Finance forecast says adoption of emission-free vehicles will happen more quickly than previously estimated because the cost of building cars is falling so fast. The seismic shift will see cars with a plug account for a third of the global auto fleet by 2040 and displace about 8 million barrels a day of oil production—more than the 7 million barrels Saudi Arabia exports today.

“This is economics, pure and simple economics,” BNEF’s lead advanced-transportation analyst Colin McKerracher said before forecasts were published on Thursday. “Lithium-ion battery prices are going to come down sooner and faster than most other people expect.”

The forecast is BNEF’s most bullish to date and is more aggressive than projections made by the International Energy Agency. Surging investment in lithium-ion batteries, higher manufacturing capacity at companies including Tesla Inc. and Nissan Motor Co., as well as emerging consumer demand from China to Europe support BNEF’s projections, which also include:

• In just eight years, electric cars will be as cheap as gasoline vehicles, pushing the global fleet to 530 million vehicles by 2040

• Electricity consumption from EVs will grow to 1,800 terawatt-hours in 2040, or 5 percent of global power demand, from 6 terawatt-hours in 2016

• There's around 90 gigawatt hours of EV lithium-ion battery manufacturing capacity online now, and this is set to rise to 270 gigawatt hours by 2021.

Charging infrastructure will continue to be an issue with bottlenecks capping growth in key Chinese, U.S. and European markets emerging in the mid-2030s Lithium-ion cell costs have already fallen by 73 percent since 2010 and BNEF predicts innovation of battery manufacturers will accelerate and lead to further steep declines in average prices over the next two decades. While they won’t fall as fast as solar panels, it could still lead to suppliers getting squeezed as they compete for contracts, McKerracher said.

“There’s an element of competitive dynamics and a real possibility of oversupply in the lithium ion battery market that will serve to hammer down prices,” he said.

The world may need the equivalent of 35 of the so-called Gigafactories like the one built by Tesla founder Elon Musk in Nevada over the next 13 years to meet the power demands of electric cars, according to BNEF.

The global shift toward electric vehicles will create upheaval for the auto industry: from oil majors harmed by reduced gasoline demand to spark plug and fuel injection manufacturers whose products aren’t needed by plug-in cars. BNEF, which last year forecast as much as 13 million barrels of oil a day displaced by electric cars, said its revised 8 million barrel a day figure is “likely understated.”

While traditional car suppliers may be hurt by EV growth, some commodities will get a lift, according to BNEF:

• Graphite demand will soar to 852,000 tons a year in 2030 from just 13,000 tons in 2015

• Nickel and aluminum demand will both see demand from EVs rise to about 327,000 tons a year from just 5,000 tons in 2015

• Production of lithium, cobalt and manganese will each increase more than 100-fold

It’s the world’s biggest economies—China, the U.S. and Europe—that will drive demand for battery powered cars over the next 25 years, according to BNEF. These governments which have already been the most advanced in providing subsidies and installing charging points, will reap the benefits sooner than other emerging economies like India.

"Electric cars are intrinsically cheaper than gas or oil fuelled cars because they're simpler and their maintenance is a lot easier,” said Enel SpA Chief Executive Officer Francesco Starace said in an interview in Rome.

In Europe, almost 67 percent of new cars sold will be electrified in 2040, and 58 percent of sales in the U.S. and 51 percent in China, BNEF said. Though there's uncertainty in the U.S., where President Donald Trump could dramatically disrupt electric vehicle growth by withdrawing support for the technology in the world’s second biggest car market.

“The next 6 to 8 years become really critical,” McKerracher said. “If those volume amounts falter dramatically, then some of those cost reductions may not come to pass and that will affect the crossover point and therefore the overall adoption level.”

https://www.bloomberg.com/news/articles/2017-07-06/the-electric-car-revolution-is-accelerating

Recent Posts

- The 2022 Audi Q4 e-Tron SUV combines performance, practicality and luxury

- Ford's 2022 F150 Lightning All-Electric Truck is in high demand

- Legendary Audi performance is at the heart of the 2022 Audi e-tron GT and its RS sibling.

- Meet the Lexus RZ 450e – the luxury brand’s 1st EV

- The 2022 GV60 is Genesis’ first all-electric vehicle